Global oil market: price decline, rising production, and the 2026 outlook

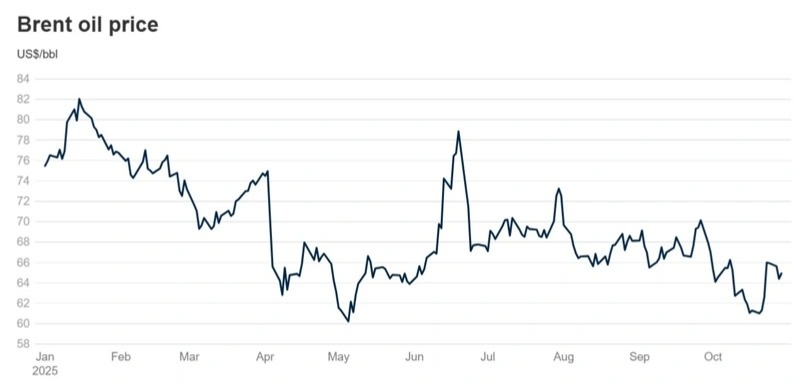

Throughout 2025, the price of Brent crude fell from $75 per barrel in April to $62 per barrel in December. The factors behind this trend and expectations for 2026 were examined by a Qazinform News Agency correspondent.

Why oil prices declined

The main reason for the decline in hydrocarbon prices was an oversupply in the global market, driven by a combination of factors.

First, global oil production increased significantly in 2025, primarily due to countries outside OPEC+. According to the U.S. Energy Information Administration (EIA), oil production in the United States reached a record 13.6 million barrels per day (bpd), up from 13.2 million bpd in 2024. Most of the increase came from the Permian Basin in Texas and New Mexico. In 2026, U.S. crude oil production is expected to average about 13.4 million bpd, according to EIA forecasts.

In June, Brazil set a record for oil production, exceeding 4.9 million bpd, with an annual average of about 4.4 million bpd, compared to 3.3 million bpd in 2024. In 2026, production is forecast to rise to 4.5 million bpd due to the commissioning of new platforms and increased output at existing fields, including Búzios, Mero, and Tupi.

In August, Guyana began developing the Yellowtail field, increasing total oil production to about 810,000 bpd, compared with 616,000-624,000 bpd in 2024. Analysts believe Guyana could become one of the key non-OPEC oil producers, with output potentially reaching 1.3 million bpd by 2027.

Argentina also recorded a historic high in oil production, at 830,000-860,000 bpd, up from around 717,000 bpd in 2024. Growth was driven by the rapid development of shale resources at Vaca Muerta, the country’s largest oil and gas field. By 2026, production could reach 1 million bpd, according to forecasts.

Second, throughout the year, key OPEC+ countries repeatedly increased oil production.

The first production increase occurred in April, when output rose by 138,000 bpd. In May and June, production increased by an additional 411,000 bpd each month. As a result, total output growth from April to June amounted to 960,000 bpd.

In July, production rose by another 411,000 bpd, followed by 548,000 bpd in August and a record 630,000 bpd increase in September. Of this total, OPEC countries accounted for 524,000 bpd, while other OPEC+ members contributed 106,000 bpd.

In October and November, OPEC+ countries agreed to increase production by a further 137,000 bpd, citing high global oil inventories and the need to prevent a sharp price decline.

The increase in oil production was driven by several factors:

– since April 2025, OPEC+ countries have sought to protect market share amid rapid production growth in the United States, Brazil, Guyana, and Argentina;

– from April to October 2025, oil prices largely remained within a range considered comfortable for OPEC, but toward year-end inventories began to build, putting downward pressure on prices;

– many OPEC members required additional revenues to finance budgets, social programs, and infrastructure projects, particularly Iraq, Nigeria, Algeria, and Saudi Arabia;

– strong oil demand from Asian economies, especially China and India, supported higher production levels.

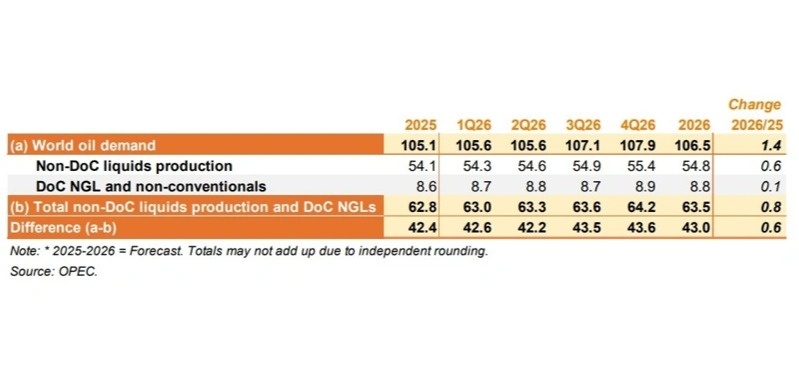

Third, according to OPEC data, supplies of natural gas liquids (NGLs) - including ethane, propane, butane, isobutane, and gas condensate - increased by 1 million bpd in 2025, reaching an average of 54.1 million bpd.

In 2026, OPEC expects global liquid hydrocarbon production to rise by 0.6 million bpd, to 54.8 million bpd, driven mainly by Brazil, Canada, the United States, and Argentina.

The United States remains the world’s largest NGL producer, accounting for about half of global output. In 2025, U.S. NGL production grew by around 0.5 million bpd, supported by drilling activity in the Permian Basin (about 5.6 million bpd), as well as in the Bakken (1.2 million bpd) and Eagle Ford (1 million bpd).

Canada also recorded significant growth in NGL production, driven by rising natural gas output and the development of bituminous oil sands. In the Middle East, growth in associated liquid hydrocarbon production was observed in Saudi Arabia, the UAE, and Qatar. In Latin America, particularly in Argentina and Brazil, higher gas output and oil production with high associated gas content supported overall growth. Norway saw moderate NGL growth due to the development of gas platforms.

What awaits the oil market in 2026

Overall, Brent crude remains under downward pressure. Markets expect supply to exceed demand in 2026, sustaining pressure on prices. In its December report, OPEC forecast global oil demand growth of 1.4 million bpd in 2026, to 106.5 million bpd, up from 105.1 million bpd in 2025, indicating a continued global surplus.

Demand growth in 2026 is expected to be modest: 0.12 million bpd in the United States, 0.04 million bpd in the EU, 0.19 million bpd in China, and 0.22 million bpd in India, according to OPEC.

The EIA expects Brent crude prices to fall to about $60 per barrel by the end of 2025 and to average around $51 per barrel in 2026.

Jay Pelosky, founder and global strategist at TPW Advisory, said analysts broadly agree that oil prices will remain under pressure in 2026 as supply continues to outpace demand. Citing an EIA report, he noted: “Low oil prices in early 2026 are expected to lead to supply reductions from both OPEC+ and some non-OPEC producers, slowing inventory growth later in the year. We forecast an average Brent price of $51 per barrel in 2026.”

Goldman Sachs forecasts an average Brent price of $56 per barrel in 2026 and $52 per barrel for WTI. According to the bank, prices could recover to $76-80 per barrel in 2027–2028 as prolonged low prices weigh on investment in oil-producing countries.

Daan Struyven, Co-Head of Global Commodities Research at Goldman Sachs, said Brent could fall to $56 in 2026 due to persistent oversupply, but rebound to $80 per barrel by the end of 2028 as low prices constrain non-OPEC supply after years of underinvestment.

At the same time, Goldman Sachs does not rule out a drop to around $40 per barrel in 2026–2027 if non-OPEC supply proves more resilient or if the global economy enters a recession. Conversely, prices could exceed $70 per barrel amid rising geopolitical risks, including possible U.S. interceptions of sanctioned tankers and a sharp decline in exports from major producers.

Earlier, Qazinform News Agency reported that President Donald Trump announced a “total and complete blockade” of sanctioned oil tankers linked to Venezuela, escalating U.S. economic and military pressure on President Nicolás Maduro’s government.