Central Asia’s rare earth opportunity: The C5+1 Summit and the future of regional economic diplomacy

As preparations intensify for the C5+1 Leaders’ Summit in Washington on November 6, with the participation of Kazakhstan President Kassym-Jomart Tokayev, the focus of the high-level dialogue between the United States and the five Central Asian republics is expected to center on critical minerals, energy logistics, and resilient infrastructure. The meeting comes at a decisive moment: with global supply chains undergoing strategic realignments, both Washington and the Central Asian capitals are seeking to convert current geopolitical volatility into long-term economic opportunity. In this analytical review, a Kazinform News Agency correspondent examines the emerging dynamics of U.S.–Central Asia cooperation, the strategic significance of the upcoming summit, and the region’s growing role in shaping a diversified global supply chain.

Kazakhstan stands at the heart of this effort. Recent geological surveys conducted in 2024–2025 have identified 38 promising deposits of solid minerals, including rare earth elements. Among them, the Kuyrektykol site in the Karaganda region has drawn particular attention for its substantial reserves. This discovery reinforces Kazakhstan’s status as a regional leader in mineral resources, complementing its already dominant position in uranium production. Today, the country supplies about 40% of the world’s uranium and nearly a quarter of U.S. imports, positioning it as an indispensable partner for America’s energy and defense industries.

Experts note that Kazakhstan naturally stands out among the Central Asian states. Not so much because of its GDP size or large-scale investments in building new transport corridors, but also thanks to its experience in conducting negotiations at the global level, especially when it comes to the President of Kazakhstan, Kassym-Jomart Tokayev, whose extensive background in foreign policy includes work at the highest levels within international organizations.

In neighboring Uzbekistan, momentum is also building. The memorandum of understanding signed with the U.S. in September 2024 on critical minerals cooperation marked a significant milestone, deepening bilateral engagement and signaling Tashkent’s intent to diversify beyond hydrocarbons. The United States International Development Finance Corporation (DFC) has expressed readiness to co-finance midstream mining and processing projects across Central Asia, though most initiatives remain in their formative stages.

At the same time, the Middle Corridor, a multimodal transport route linking China to Europe through Central Asia and the Caspian Sea, continues to emerge as a strategically vital artery for Western-aligned supply chains seeking alternatives to routes that traverse Russia or Iran. The Trans-Caspian International Transport Route (TITR) has already doubled its cargo volumes in the past two years and could soon handle up to 10 million tons annually. By investing in rail, port, and customs modernization, the U.S. and its allies aim to create sanctions-proof logistics corridors that connect Central Asia to global markets under transparent and secure frameworks.

Washington’s goals and Central Asia’s expectations

For Washington, the November summit represents a chance to reduce strategic dependence on China and consolidate reliable access to rare earths, battery metals, and energy resources. Beyond energy security, the initiative seeks to anchor U.S. commercial presence in a region that has long balanced between global powers. Kazakhstan, which accounts for over half of Central Asia’s GDP and three-quarters of U.S. trade with the region, naturally occupies center stage.

American companies are already deeply embedded in Kazakhstan’s economy. Major firms such as Chevron, ExxonMobil, PepsiCo, and Meta have operated in the country for years, while newer entrants like Wabtec recently signed a $4.2 billion agreement to manufacture next-generation locomotives in Astana. Over 630 American companies are now active in Kazakhstan, which has attracted more than $100 billion in cumulative U.S. investment since independence.

A central example of the evolving partnership is the $1.1 billion rare earth value chain project launched with U.S.-based Cove Capital. The initiative aims to move beyond raw material exports and establish advanced processing capacity, ensuring both supply security for Washington and greater industrial value for Kazakhstan.

For Central Asia, the expectations are equally clear. Governments across the region seek political recognition, technology transfer, and diversification beyond hydrocarbons. The summit provides a high-profile platform to showcase progress on digital transformation, logistics connectivity, and green energy.

Kazakhstan, in particular, has embraced an ambitious digital modernization agenda, positioning itself as a regional IT hub. Partnerships with Nvidia, Amazon, Microsoft, Meta, and Starlink are already transforming the country’s technological landscape. Recent initiatives include the creation of a Kazakh-language AI model with Meta, the expansion of satellite internet through Starlink, and the rollout of cloud and digital finance solutions. What Kazakhstan seeks next are deep partnerships in research, education, and regulatory frameworks that can help scale its digital economy.

In parallel, investment in transport and energy infrastructure remains a shared regional priority. While the European Union has advanced funding through its Global Gateway initiative, Central Asian governments now look to Washington for complementary financing and technical expertise, especially in the development of the Trans-Caspian route and the green energy transition.

Between opportunity and uncertainty

The Trump–Xi meeting in Busan has altered the diplomatic atmosphere ahead of the C5+1 summit. The tentative “reset” between Washington and Beijing has softened global rhetoric but introduced uncertainty over the depth of U.S. commitment to supply chain diversification. For Kazakhstan and its neighbors, whose policies are grounded in multi-vector diplomacy and neutrality, this ambiguity presents both challenges and opportunities.

Analysts largely agree, however, that the underlying structural competition between the U.S. and China persists. Even if near-term tensions ease, the strategic rationale for diversifying supply chains remains intact. Central Asia’s integration into midstream processing and regional value chains is not a matter of short-term diplomacy but of long-term resilience. In this respect, the region’s governments are increasingly pragmatic: open to cooperation with all partners but insistent on predictable, mutually beneficial relationships.

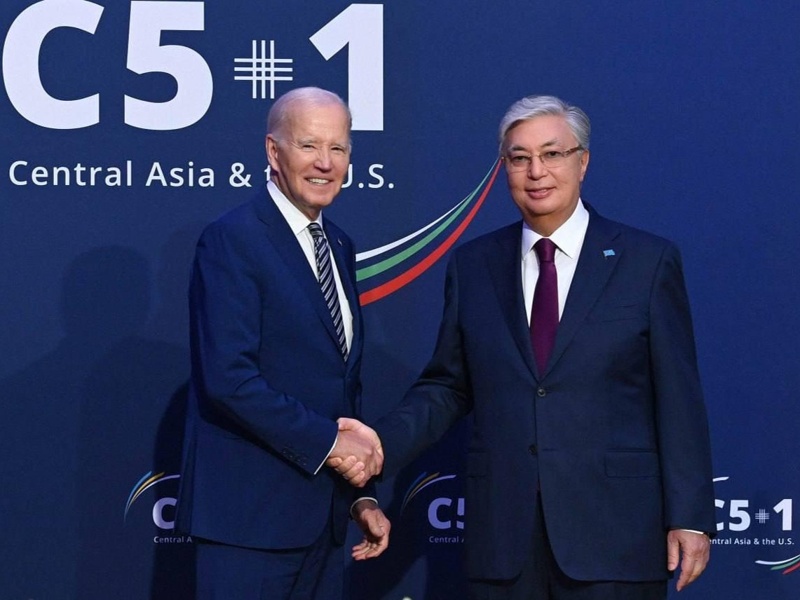

The year 2023 became a turning point — it was during this period that, for the first time in history, the C5+1 dialogue rose to the level of heads of state. The inaugural meeting took place on the sidelines of the UN General Assembly. It was quite symbolic that the Presidents of Kazakhstan and the United States, Kassym-Jomart Tokayev and Joe Biden, were seated side by side during the talks. This made it possible to communicate without an interpreter and contributed to a closer mutual understanding.

At the end of September this year, President Tokayev paid a working visit to New York to participate in the 80th session of the UN General Assembly. As customary, he held a meeting with U.S. business leaders. The results were impressive — 11 agreements and memoranda were signed between major Kazakh and American companies totaling $5.2 billion in the fields of transport, logistics, energy, and information technology.

Today, the tradition of high-level meetings continues under U.S. President Donald Trump. On November 6 in Washington, the leaders of the Central Asian Five and the head of the White House will meet to discuss in detail the issues of multilateral cooperation. This sequence of summits demonstrates the continuity of dialogue and the growing strategic weight of the C5+1 format in shaping regional development priorities.

The upcoming summit will test whether the C5+1 platform, now entering its tenth year, can evolve beyond political symbolism into a mechanism for tangible economic cooperation. The key indicator will be Washington’s willingness to support midstream industrial projects—refining, processing, and technology development—rather than limiting engagement to upstream resource extraction. Without this, the region risks remaining a supplier of raw materials rather than a partner in value creation.

Equally important will be how the United States manages geopolitical sensitivities. Expanded cooperation in geospatial data, dual-use technologies, or energy security may invite responses from Russia and China, both of which retain strong economic and security influence in the region. Astana, Tashkent, and other capitals will thus continue their careful balancing act, ensuring that U.S. partnership complements rather than replaces their existing relationships.

In the final analysis, the November summit offers a window of opportunity for both sides. For Washington, it is a chance to demonstrate credibility and consistency in its Eurasian strategy. For the Central Asian republics, it is an opening to convert geopolitical attention into investment, innovation, and industrial capacity.

Whether the meeting produces durable outcomes or another round of aspirational communiqués will depend on the ability to translate strategic intent into capital, technology, and implementation. If the summit delivers on its promises, it may open a new chapter in U.S.–Central Asia relations, defined by practical cooperation and a shared commitment to building a diversified and resilient economic future.

Earlier, it was reported that President Kassym-Jomart Tokayev had sent a letter to U.S. President Donald Trump, expressing sincere appreciation for the invitation to participate in the Central Asia–United States Summit set to be held in Washington on November 6.