A world of difference: Mobile and Internet costs across countries

The global telecommunications market grew by 3.3% in 2024, reaching $1.18 trillion. In Kazakhstan, the sector expanded by 8% from the beginning of the year, amounting to 233 billion tenge. A Kazinform News Agency correspondent examines how the rising demand for telecommunications services is influencing pricing policies across different countries.

U.S. pricing policy is driven by competition

The U.S. telecommunications market is one of the largest and most competitive in the world, with pricing policies shaped by market forces as well as regulatory bodies such as the Federal Communications Commission and the Federal Trade Commission. Recent changes have been driven by advancements in mobile technology, the transition to 5G, the surge in data usage, and mergers among major industry players.

According to Mordor Intelligence, the U.S. telecommunications market is valued at $443.12 billion in 2024 and is expected to reach $530.61 billion by 2029, growing at an average annual rate of 3.67% over the forecast period.

Major American operators such as AT&T, Verizon, US Cellular, and T-Mobile offer a wide range of plans. In some areas, high-speed internet — including fiber-optic services — is available, with varying speeds and pricing options.

Mobile service costs can differ depending on the provider, plan, and region. According to Yesim.tech, a standard mobile plan in the U.S. typically ranges from $30 to $70 per month.

EU takes measures against monopolization

In European Union countries, telecommunications tariffs are traditionally regulated at the level of the European Commission to ensure uniform standards and a competitive environment among member states.

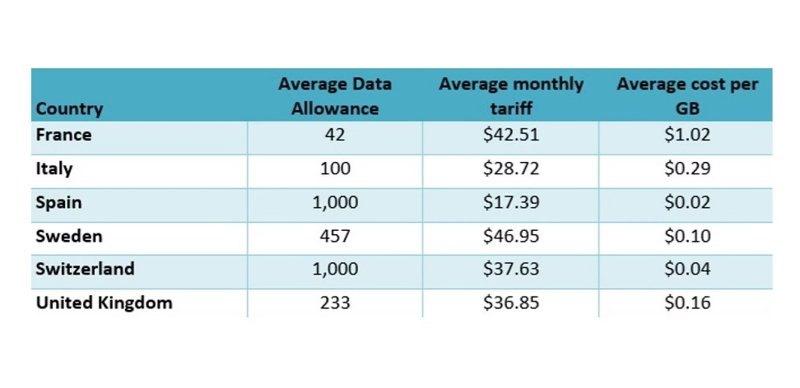

Across much of the EU, operators offer unlimited data plans with high-speed internet (4G/5G) for a fixed monthly fee. Roaming charges were liberalized in 2017 with the introduction of the "Roam Like at Home" rules, which eliminated additional fees for calls and internet usage across EU countries. These regulations allow mobile users to make calls, send SMS messages, and use mobile data throughout the EU at the same rates as in their home country, without extra roaming charges.

The cost of broadband internet varies by region. In densely populated countries like Germany and France, broadband services are generally more affordable, whereas in rural areas, prices may be higher due to the greater cost of infrastructure development.

A key focus of EU policy is preventing monopolization. The EU strictly monitors mergers and acquisitions among major operators to safeguard consumer choice and prevent price increases. One example is the investigation into the proposed merger between Telecom Italia and Vivendi in 2016, amid concerns that the deal could reduce market competition.

State control over telecom operators in China

China’s approach to telecommunications pricing is unique, largely shaped by the scale of its economy and the high level of state control. Government oversight of telecom operators enables the implementation of centralized policies aimed at achieving long-term goals, such as advancing the country’s digital transformation and ensuring the accessibility of internet services.

China is striving to become a global leader in technology and innovation. Its recent achievements include rapid growth in mobile and international communications. Data and voice bundles are currently popular among Chinese consumers, while the development of 5G infrastructure is accelerating. Subsidies are also being introduced to encourage the uptake of mobile internet services.

The average cost of mobile data in China is about $0.20 to $0.30 per gigabyte. Unlimited data plans typically range from $12 to $20 per month.

The world’s cheapest mobile market

India boasts the world’s most affordable mobile market, driven by intense competition among operators and the widespread popularity of mobile internet.

Subscribers can choose from a wide range of plans, including some of the cheapest options for calls and internet access. Operators such as Reliance Jio offer unlimited plans with bundled data for just a few dollars per month.

Internet services are available at low prices, although connection speeds can vary greatly across regions. The average cost of mobile data is less than $1 per gigabyte. Popular plans offering between 10 and 30 GB of data per month typically range from $3 to $5. Indian operators frequently provide large data allowances — often up to 50–100 GB — along with unlimited calls and SMS at very low prices.

Tariff regulation in Azerbaijan

In Azerbaijan, the telecommunications market is dominated by several major operators, including Azercell, Bakcell, and Nar Mobile. These companies offer a range of plans tailored to customer needs — from budget packages with basic services to unlimited plans with high-speed internet.

Fiber-optic technologies and high-speed internet are available in the country’s major cities, although rural areas may still face connectivity challenges. The Azerbaijani government actively regulates tariffs in the telecommunications sector to encourage competition and maintain service affordability.

According to statistics, the average cost of fixed broadband internet in Azerbaijan is about $16.59 per month, compared to $8.77 in neighboring Turkey and $9.14 in Moldova.

Mobile internet prices rise in Kazakhstan

Kazakhstan’s telecommunications sector is characterized by intense competition among the major operators — Kcell, Beeline, and Tele2. These operators offer a variety of plans, including unlimited mobile internet and call packages. According to the Internet Accessibility Index by MoneySuperMarket, Kazakhstan ranks among countries with low costs for 1 GB of data, with an average price of $0.59 per gigabyte. For comparison, the average cost of 1 GB of data in Tajikistan is $1.65, in Uzbekistan it’s $0.60, and in Kyrgyzstan, 1 GB costs $0.17.

However, since the beginning of the year, prices for some mobile plans have started to rise. The average increase has already reached 25%, and from April 2025, mobile operators in Kazakhstan announced price hikes (on various plans) ranging from 500 to 1,500 tenge, citing rising costs for network development, modernization, maintenance, repair, and higher equipment prices.

Prospects for the global telecommunications market

According to Analysys Mason, the global telecommunications market is expected to continue growing. The publication notes that global telecom service revenue increased by 2% year-on-year in 2024.

The growth in revenue from traditional telecommunications services is largely driven by higher spending on data transmission services. Analysys Mason predicts that the construction of fiber-optic networks and the growing demand for faster broadband lines will lead to increased average spending per user for fixed-line services, particularly in North America and Western Europe. The North American mobile market is also expected to see higher revenue growth in the coming years compared to Europe.

Earlier, Kazinform News Agency reported that World’s first 10G broadband network launched in China.