World Bank supports Kazakhstan's efforts to reduce sugar consumption with smart taxes

According to World Bank Kazakhstan has seen a 50% increase in sugary drink consumption, leading to a public health challenge, with nearly a quarter of children overweight or obese, Kazinform News Agency correspondent reports.

Between 2018 and 2023, per capita sales of sugar sweetened beverages rose by 50%, largely due to rising intake by young people, with half of school-aged children consuming these products on a weekly basis. Higher sugar consumption is linked to health problems such as type 2 diabetes, obesity, tooth decay, stroke risk, and various types of cancer. Today, such sugary drinks are 13% cheaper than water.

Smart Taxes

121 countries worldwide have implemented sugary sweet beverage taxes, including national-level taxes in 106 countries. These taxes encourage consumers to make healthier choices, while at the same time raising revenues to spend on development priorities.

The World Bank praised Kazakhstan's proposal to introduce the tax, developed by the Ministry of Health in 2023, noting that it was designed with two elements of a well-designed tax.

First, taxes need to target the sugar content of a drink, rather than the value of the product. In other countries, the new tax has helped to lower the amount of sugar in a beverage. Second, it is recommended that the tax rate should be at least 20% of the retail price to be meaningful.

Tax effect

Although governments may initially be concerned about how such a tax affects business, evidence from other countries shows these concerns are often overstated. The manufacturers of sugar-sweetened beverages also produce alternatives such as water and diet drinks. As consumers consider other ways of quenching their thirst, spending is typically reallocated to different products.

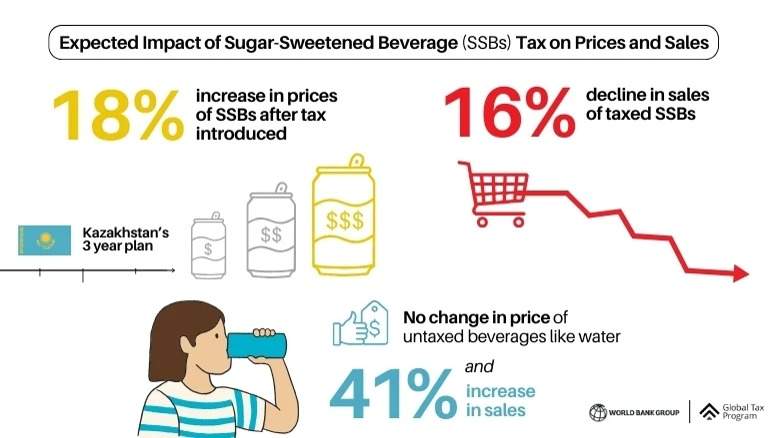

According to World Bank modeling, the tax would reduce the sales of sugary drinks by 16% while purchases of bottled water are expected to increase by 41%. Overall, only a 3% decline in the sales of all non-alcoholic beverages is expected, limiting any potential adverse effects on the economy.

The tax is projected to increase government revenues by around 0.25% of GDP by the third year, similar to the amount collected from tobacco taxes (in 2021), and more than alcohol taxes currently contribute.

Earlier, we wrote about the nutrition of the nomadic peoples of Central Asia, as well as modern challenges in the field of nutrition and health.