Financial stability risks have grown – IMF report

In recent years, global financial stability has come under growing pressure due to tighter financial conditions, rising geopolitical tensions, and trade-related risks. In its latest report, the International Monetary Fund highlights three key vulnerabilities in the financial system, Kazinform News Agency correspondent reports.

First, capital markets have become increasingly concentrated, with the U.S. now accounting for roughly 55% of the global equity market—up from 30% two decades ago. Despite recent sell-offs, asset valuations remain elevated, raising the risk of further corrections amid ongoing economic uncertainty.

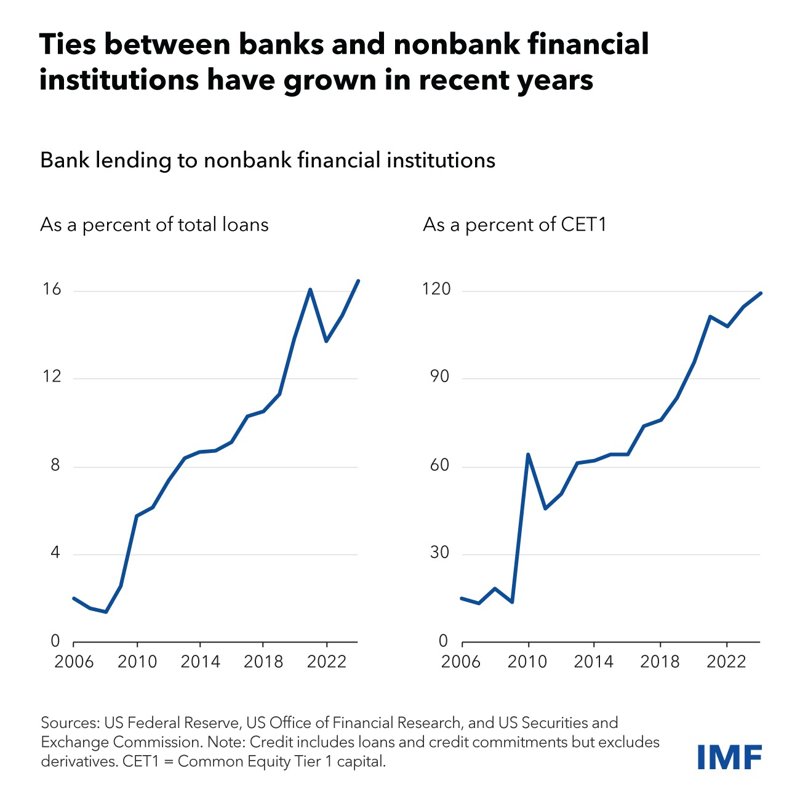

Second, the growing role of nonbank financial institutions (NBFIs), which actively channel savings into investments, could pose a threat if asset prices continue to decline. A wave of deleveraging in this sector could intensify market disruptions.

Third, sovereign debt levels continue to climb, outpacing the development of market infrastructure needed to support financial stability. Countries with high debt levels are especially vulnerable, as this adds to volatility in government bond markets. Riskier emerging markets facing widening sovereign bond spreads may struggle to refinance existing debt or fund additional public spending.

Banks play a central role in safeguarding financial stability. However, despite using various risk-mitigation tools, their deepening ties with NBFIs raise the risk of financial contagion unless strict regulatory frameworks and debt oversight measures are put in place.

The IMF stresses the need to strengthen financial reporting requirements for NBFIs to distinguish entities that support healthy financial intermediation from those engaging in excessive risk or poor governance. Full implementation of international regulatory standards, such as Basel III, is also recommended to enhance the resilience of the banking sector.

Amid rising sovereign debt, countries must improve their debt management strategies and reinforce bond market infrastructure to mitigate threats to financial stability.

Earlier, Kazinform News Agency reported that JPMorgan warned of global recession risk amid new U.S. tariffs.