75% of global wealth held by 10% of the population

By 2025, the richest 10 percent of the world’s population will have concentrated around 75 percent of global private wealth, Qazinform News Agency reports.

The global economy continues to expand, yet the benefits of this growth are distributed highly unevenly. According to the World Inequality Report, global inequality has ceased to be a side effect of development and is increasingly taking on a structural character, affecting not only income levels but also political dynamics, climate policy, and the long-term stability of economic systems.

The report’s authors estimate that in 2025 the bottom 50 percent of the global population owned just 2 percent of total assets, while the top 10 percent controlled 75 percent of global wealth and captured 53 percent of total world income. By comparison, half of the world’s population accounted for less than 10 percent of global income. These proportions reflect not merely social stratification, but a redistribution of economic power on a global scale.

Wealth is growing faster than the economy

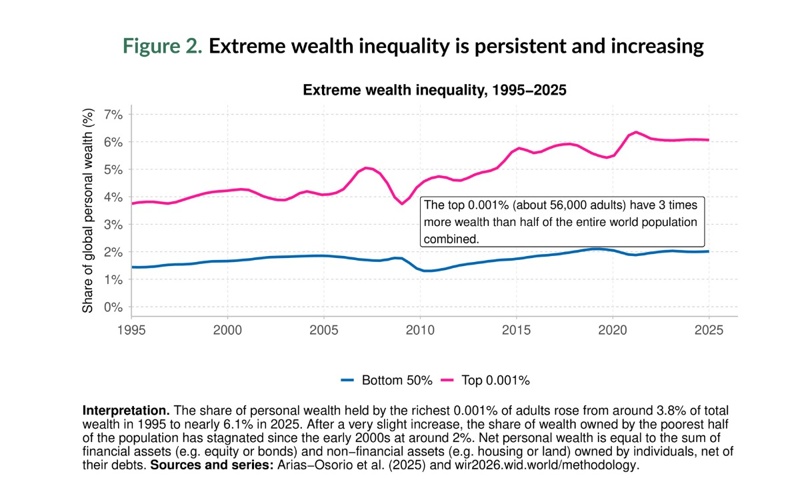

One of the main conclusions of the report is that capital accumulation at the top of the distribution is occurring much faster than growth in the global economy as a whole. Since the mid-1990s, the wealth of billionaires and multimillionaires has increased at an average rate of around 8 percent per year, nearly twice the income growth rate of the bottom half of the population.

As a result, fewer than 60,000 people in the top 0.001 percent now own assets whose combined value is roughly three times greater than the total wealth of half of humanity. The share of this group in global wealth rose from about 4 percent in 1995 to more than 6 percent by 2025, pointing to an accelerating concentration of resources.

These figures indicate a shift in the very logic of accumulation. Economic growth is being redistributed less through wages and increasingly entrenched through ownership of capital. As a result, the primary beneficiaries of development are those who already hold assets.

Climate as a mirror of inequality

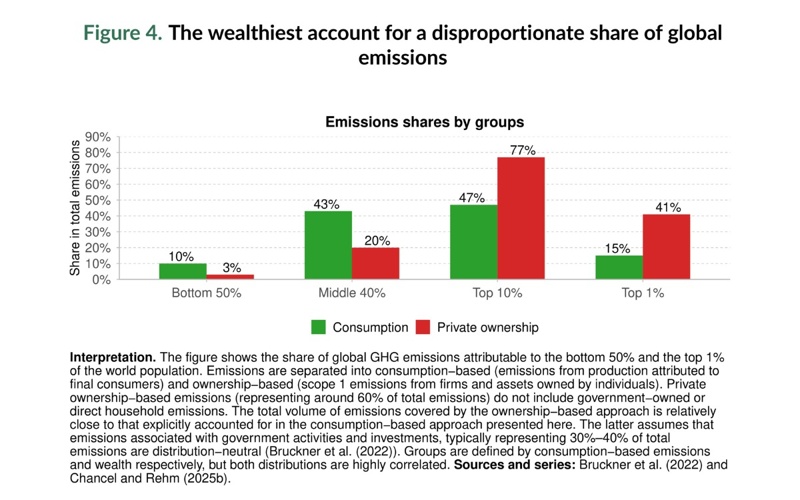

The report also shows that economic inequality is directly linked to the climate crisis. According to researchers, the richest 10 percent of people worldwide are responsible for 77 percent of greenhouse gas emissions associated with capital ownership and 47 percent of emissions linked to consumption.

At the same time, the poorest half of the population generates only about 3 percent of capital-related emissions. Yet these groups bear the greatest losses from climate change. In this way, the concentration of wealth leads not only to economic but also to environmental imbalance, deepening inequality between regions and social groups.

Gender gap and the “invisible economy”

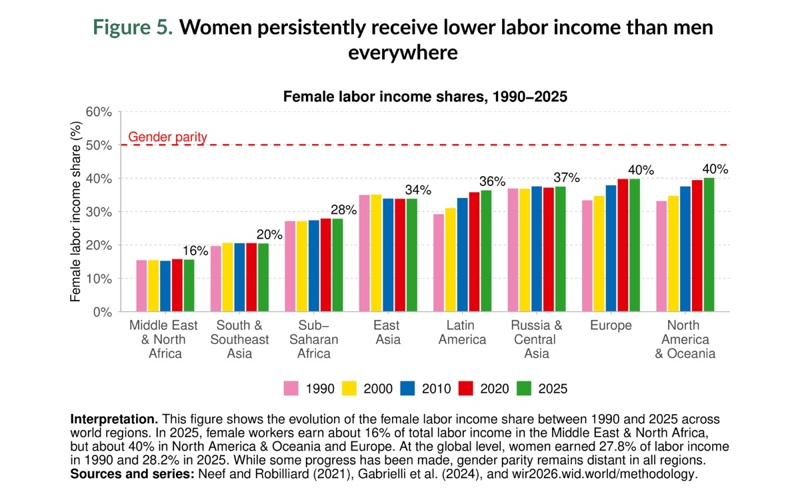

Another structural dimension of global inequality highlighted in the report is gender imbalance. On a global scale, women receive only about 28 percent of total labor income, a figure that has changed little since 1990.

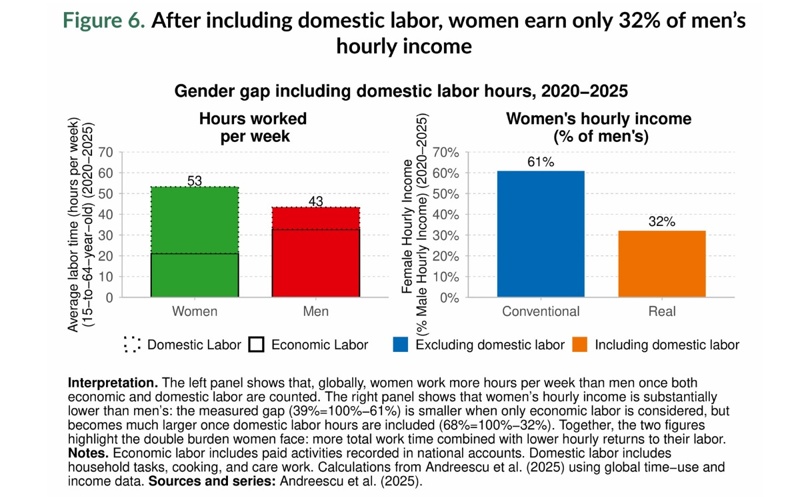

When unpaid domestic and care work is taken into account, women work an average of around 53 hours per week, compared with 43 hours for men. However, their hourly income amounts to just 32 percent of men’s. This limits women’s ability to accumulate capital and reinforces the mid-term reproduction of inequality.

Geography of opportunity

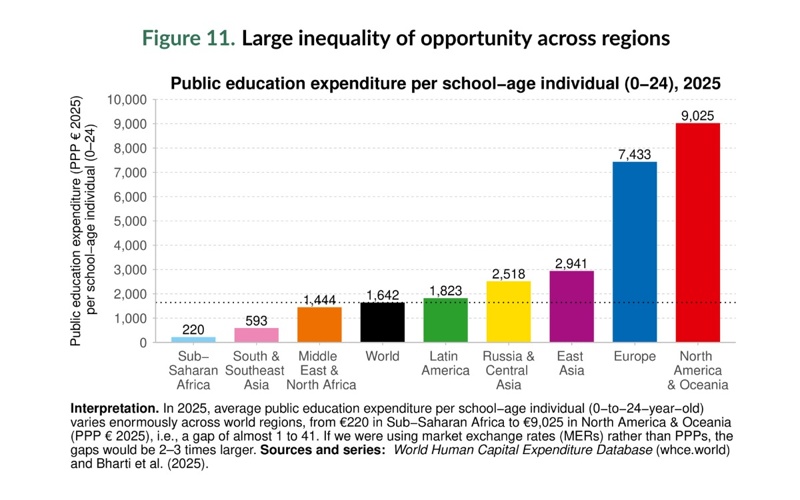

Unequal access to human capital plays a major role in entrenching global inequality. Average monthly income per capita in North America and Oceania exceeds 3,800 euros, while in Sub Saharan Africa it is around 300 euros.

The gap in education investment is even more pronounced. In 2025, spending per student in Sub Saharan Africa amounted to about 220 euros per year, compared with more than 9,000 euros in North America and Oceania, a difference of over 40 times. These disparities create persistent “inequality of opportunity” that reproduces itself regardless of individual effort or skill.

The financial system as a mechanism of resource transfer

The report emphasizes that the international financial system plays a central role in sustaining global inequality. Experts estimate that around 1 percent of global GDP is redistributed each year from developing countries to advanced economies through debt payments, profit repatriation, and financial flows.

This amount is roughly three times larger than total international development aid, significantly limiting poorer countries’ ability to invest in education, healthcare, and infrastructure. In practice, this represents a built-in mechanism of constant net resource transfer from poorer economies to wealthier ones.

What these findings show

The World Inequality Report stresses that today’s level of inequality is the result of political and institutional choices, rather than an inevitable outcome of economic development. The authors identify progressive taxation, expanded investment in human capital, and reform of the global financial architecture as key tools for addressing the problem.

According to expert estimates, even a moderate global tax on the wealth of the ultra rich could generate additional revenues of up to 1 percent of global GDP, which could be directed toward social and climate programs. Without such changes, the report warns, wealth concentration will continue to intensify, posing risks to economic resilience and social stability.

Earlier, Qazinform News Agency reported that President Kassym-Jomart Tokayev emphasized that economic growth should be accompanied by a reduction in social inequality and the strengthening of the middle class.